Taxes on Selling Land in Wisconsin include both state income taxes of 3.50% to 7.65% on your capital gains (Wisconsin has no separate capital gains rate) plus federal taxes up to 20%.

However, Wisconsin offers a valuable 30% deduction on long-term gains, and agricultural land qualifies for a 60% deduction. Dive in to get the full details!

Key Takeaways:

- Wisconsin taxes land sale profits as ordinary income with rates from 3.50% to 7.65%, but offers a 30% deduction on long-term capital gains.

- You'll pay both Wisconsin state taxes and federal capital gains taxes, potentially reaching combined rates over 27% for high earners.

- Inherited land receives stepped-up basis treatment, often eliminating most capital gains taxes when sold.

Quick Note: If you're looking to skip the traditional sales process, we buy WI land fast and can provide a free, no-obligation cash offer within 48 hours.

Understanding Taxes on Selling Land in Wisconsin

Selling land in Wisconsin triggers both federal and state tax obligations that catch many landowners off guard. Unlike some states that offer preferential capital gains rates, Wisconsin taxes your land sale profits as ordinary income, potentially pushing you into higher tax brackets. Understanding these tax implications upfront helps you make informed decisions and avoid costly surprises.

Wisconsin's Unique Capital Gains Tax Structure

Wisconsin takes a different approach to capital gains taxation compared to many other states:

- No separate capital gains rate - All capital gains taxed as ordinary income

- Tax rates from 3.50% to 7.65% depending on your total income level

- 30% deduction available for long-term capital gains on most property

- 60% deduction available for qualifying agricultural land sales

This means selling land in Wisconsin could push your income into a higher tax bracket, especially for large transactions. The state's progressive tax structure applies the highest rates to your total income, including your land sale profits.

Federal Tax Obligations You'll Face

Beyond Wisconsin state taxes, you'll owe federal taxes on your land sale:

- Short-term capital gains (owned less than 1 year): Taxed at ordinary income rates up to 37%

- Long-term capital gains (owned over 1 year): Preferential rates of 0%, 15%, or 20%

- Net Investment Income Tax: Additional 3.8% for high earners

- Depreciation recapture: If you claimed depreciation on improvements

Required Tax Documentation and Reporting

Wisconsin requires specific documentation for all land sales:

- Real Estate Transfer Return (RETR) must be filed for every transaction

- Form 1099-S reporting the sale price to the IRS and the Wisconsin Department of Revenue

- Detailed records of purchase price, improvements, and selling expenses

- Professional appraisals may be required for inherited or gifted property

The complexity of Wisconsin's dual tax system often surprises landowners who assume they'll only pay federal taxes. Cash buyers can simplify your tax documentation process and help you understand exactly what you'll owe before you commit to selling. For a deep dive, check out paperwork required for selling land in Wisconsin.

Is Your Wisconsin Land Sale Taxable? (What You Need to Know)

Not all Wisconsin land sales trigger the same tax consequences. Understanding when your land sale becomes taxable—and when you might qualify for exemptions—can save you thousands of dollars.

The taxability depends on several factors, including how you acquired the land, how long you've owned it, and how you've used the property. When evaluating the Wisconsin land market, it's crucial to understand these tax implications before making any selling decisions.

When Wisconsin Land Sales Are Taxable

Most Wisconsin land sales create taxable events, but the amount you owe varies significantly:

- Investment or vacant land: Full capital gains tax applies to profit

- Primary residence with land: May qualify for up to $250,000/$500,000 exclusion

- Agricultural property: Potential for enhanced deductions up to 60%

- Commercial land: Standard capital gains treatment applies

Major Tax Exemptions and Exclusions

Wisconsin offers several ways to reduce or eliminate taxes on land sales:

- Primary residence exclusion: Up to $250,000 (single) or $500,000 (married) if land was part of your main home

- Agricultural land deduction: 60% exclusion on qualifying farm property sales

- Standard capital gains deduction: 30% reduction on long-term capital gains for most property

- Inherited property advantages: Stepped-up basis eliminates tax on appreciation before inheritance

Special Considerations for Different Property Types

The type of land you're selling dramatically affects your tax situation:

Inherited Land Benefits:

- Property receives stepped-up basis to fair market value at inheritance

- Wisconsin's unique "double step-up" for marital property

- Often eliminates most or all capital gains tax

Agricultural and Conservation Land:

- Enhanced deductions for qualifying agricultural property

- Conservation easement benefits

- Special timing considerations for crop sales

Also, if you have a unique property in WI, check out the best way to sell hunting land or lakefront properties in Wisconsin.

Required Documentation to Prove Tax Status

Wisconsin requires specific documentation to claim exemptions:

- Ownership records showing the length of ownership and use

- Primary residence documentation for home exclusion claims

- Agricultural use records for enhanced deductions

- Inheritance documentation for stepped-up basis claims

Determining taxability requires analyzing your specific situation and ensuring you have proper documentation. Our cash buying process includes tax documentation assistance to ensure you claim all available exemptions and maintain compliance with Wisconsin requirements.

How to Minimize Capital Gains Tax When Selling Wisconsin Land

Wisconsin landowners have several powerful strategies to reduce their tax burden when selling property. Since Wisconsin taxes capital gains as ordinary income, minimizing your taxable gain becomes even more critical to avoid pushing yourself into higher tax brackets.

Understanding land acre costs in Wisconsin helps you make strategic timing decisions for tax optimization.

Strategic Timing for Maximum Tax Benefits

Timing your Wisconsin land sale can dramatically impact your tax liability:

- Hold for over one year: Qualify for Wisconsin's 30% long-term capital gains deduction

- Agricultural land timing: Hold qualifying farm property for enhanced 60% deduction

- Income spreading: Coordinate sale timing with lower-income years

- Year-end planning: Time closing dates to optimize tax year benefits

Installment Sales for Income Spreading

Wisconsin follows federal rules for installment sales, allowing you to spread taxable income over multiple years:

- Reduce annual tax burden: Avoid pushing income into higher tax brackets

- Maintain lower rates: Keep total income in lower Wisconsin tax brackets (3.50%-5.30%)

- Flexible payment terms: Structure payments to optimize your tax situation

- Interest income benefits: Earn interest on deferred payments

1031 Like-Kind Exchanges for Tax Deferral

Wisconsin recognizes federal 1031 exchanges for real estate, offering complete tax deferral:

- Defer all capital gains: No immediate Wisconsin or federal tax liability

- Upgrade your investment: Exchange for higher-value or better-located property

- Strict timing rules: 45-day identification, 180-day completion deadlines

- Professional guidance required: Complex rules demand expert assistance

Maximizing Your Cost Basis

Every dollar added to your cost basis reduces your taxable gain:

- Original purchase price: Include all acquisition costs and fees

- Capital improvements: Land clearing, drainage, surveys, access roads

- Legal and professional fees: Attorney costs, title insurance, surveying

- Selling expenses: Marketing costs, legal fees, transfer taxes

Tax optimization requires expert timing and comprehensive documentation. Cash sales provide the flexibility to optimize your tax strategy while our team coordinates with tax professionals to ensure you claim every available deduction and benefit.

Wisconsin Tax Rates and Deductions for Land Sales

Understanding Wisconsin's complete tax structure helps you calculate exactly what you'll owe when selling land. Unlike states with separate capital gains rates, Wisconsin integrates all income—including land sale profits—into its progressive tax system. This approach, combined with available deductions, creates unique planning opportunities. When selling land in Wisconsin without a realtor, understanding these rates helps you keep more money in your pocket.

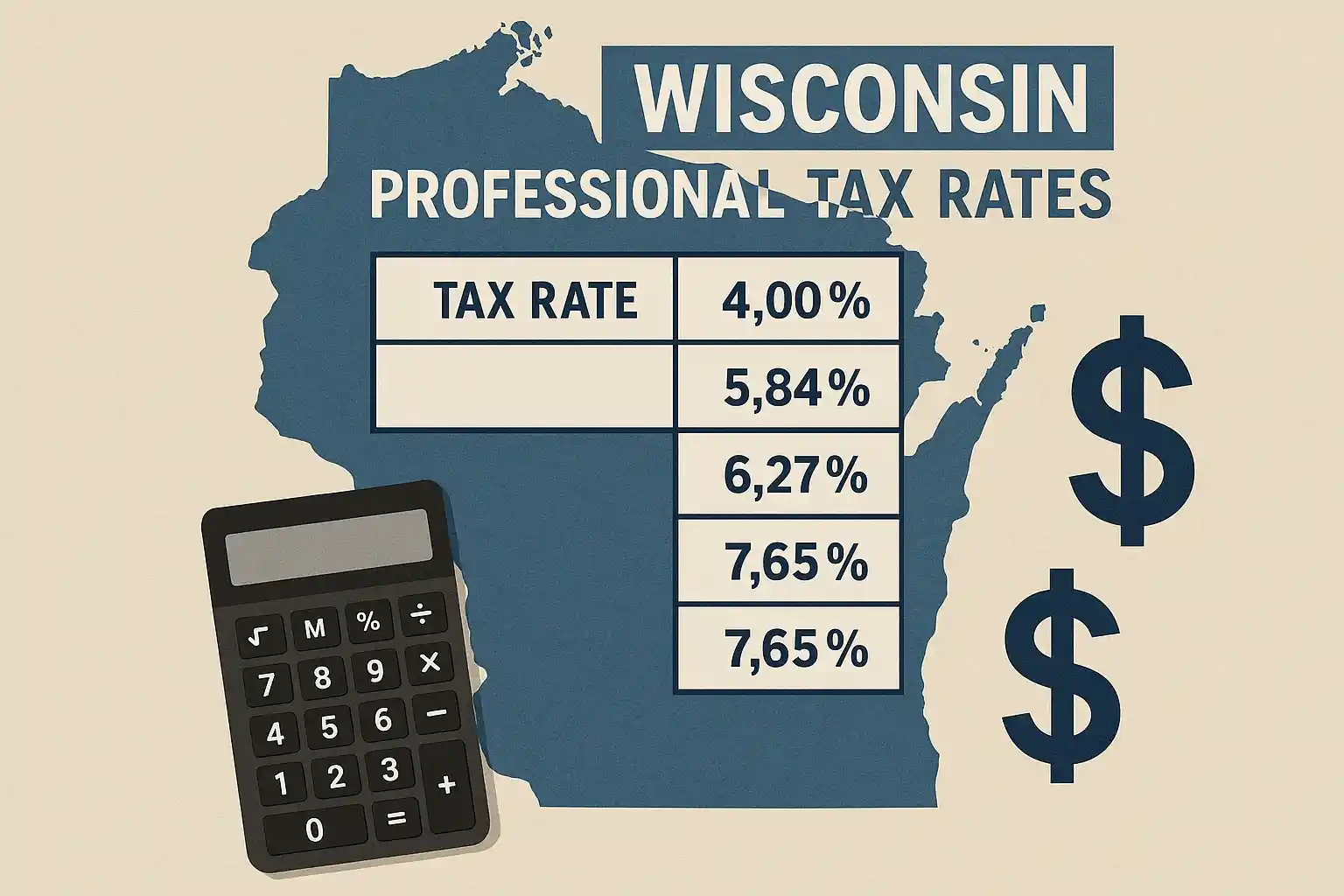

Wisconsin Income Tax Brackets for 2025

Wisconsin applies these progressive rates to all income, including capital gains from land sales:

- 3.50% on income up to $14,320 (single) / $19,090 (married filing jointly)

- 4.40% on income from $14,321-$28,640 (single) / $19,091-$38,190 (married filing jointly)

- 5.84% on income from $28,641-$315,310 (single) / $38,191-$420,420 (married filing jointly)

- 7.65% on income over $315,310 (single) / $420,420 (married filing jointly)

Federal Capital Gains Tax Obligations

Wisconsin landowners also face federal tax obligations on their land sales:

- 0% federal rate: For low-income taxpayers (up to $47,025 single / $94,050 married in 2025)

- 15% federal rate: For middle-income taxpayers (most common bracket)

- 20% federal rate: For high-income taxpayers ($518,900+ single / $583,750+ married)

- 3.8% Net Investment Income Tax: Additional tax for high earners on investment income

Wisconsin's Capital Gains Deductions

Wisconsin offers significant deductions that can substantially reduce your tax burden:

Standard Long-Term Capital Gains Deduction:

- 30% deduction on net long-term capital gains from most property sales

- Applies to land held over one year

- Reduces taxable gain before applying Wisconsin tax rates

Enhanced Agricultural Land Deduction:

- 60% deduction on qualifying agricultural property sales

- Must meet specific agricultural use requirements

- Potentially cuts taxable gain in half

Transfer Fees and Additional Costs

Wisconsin imposes additional fees on all land transactions:

- Real Estate Transfer Fee: $0.30 per $100 of sale price (0.3%)

- Real Estate Transfer Return (RETR): Required filing for all sales

- County recording fees: Vary by county, typically $30-$100

- Title insurance and closing costs: Usually paid by the buyer in cash sales

Complex rate calculations and deduction tracking pose a challenge for many landowners, particularly when attempting to estimate net proceeds from a sale. Cash buyers handle comprehensive tax documentation to help you maximize available deductions while ensuring compliance with all Wisconsin requirements.

Tax Benefits of Inherited Land Sales in Wisconsin (Step-Up Basis)

Inheriting land in Wisconsin provides significant tax advantages that can eliminate most or all capital gains taxes when you sell. Wisconsin's unique "double step-up" provision for marital property offers even greater benefits than most states. Understanding these inheritance tax advantages helps you maximize your financial benefit when you're ready to sell.

For comprehensive guidance on how to sell inherited land in Wisconsin, these tax benefits make the process even more attractive.

How Stepped-Up Basis Eliminates Capital Gains Tax

When you inherit Wisconsin land, the property receives a "stepped-up basis" to its fair market value at the time of inheritance:

- Original purchase price becomes irrelevant: Your basis resets to the current market value

- Eliminates decades of appreciation: No tax on gains that occurred before inheritance

- Immediate sale advantage: Sell shortly after inheritance with minimal capital gains

- Professional valuation importance: Proper appraisal establishes your new basis

Wisconsin's Unique Double Step-Up for Marital Property

Wisconsin is a marital property state offering exceptional benefits for surviving spouses:

- Both halves receive step-up: Unlike most states, both spouses' shares get a new basis

- Complete tax elimination: Often eliminates all capital gains tax on inherited land

- Marital property classification: Property acquired during marriage qualifies

- Significant tax savings: Can save thousands compared to joint tenancy states

No Wisconsin Inheritance Tax to Worry About

Wisconsin eliminated its inheritance tax, providing additional benefits:

- No state inheritance tax: Wisconsin doesn't tax inherited property

- Federal estate tax threshold: $13.61 million exemption for 2025

- Most estates are exempt: Very few Wisconsin estates face the federal estate tax

- Clean inheritance process: Focus on income tax planning, not estate taxes

Documentation Requirements for Tax Benefits

Proper documentation ensures you receive all available tax benefits:

- Death certificate: Required for all inheritance tax filings

- Professional appraisal: Establishes stepped-up basis value at inheritance

- Estate tax return: Form 706 if estate exceeds federal threshold

- Inheritance documentation: Will, trust documents, or probate court orders

Inherited land offers significant tax advantages, but proper documentation and timing remain crucial. Our team understands Wisconsin's inheritance tax benefits and can expedite your sale while ensuring you preserve these valuable tax advantages throughout the transaction process.

Simplify Your Wisconsin Land Sale Taxes with Cash Buyers

After reviewing Wisconsin's complex tax requirements—from RETR filings to dual taxation systems—many landowners feel overwhelmed by the documentation and planning involved. That's where we come in.

At Prime Land Buyers, we've helped dozens of Wisconsin landowners navigate these tax complexities while getting fair cash offers for their property.

How We Handle Wisconsin Tax Documentation

When you sell land for cash in Wisconsin with us, we simplify the entire process:

- RETR filing assistance: We handle Real Estate Transfer Return documentation

- Tax consultation coordination: Connect you with Wisconsin tax professionals when needed

- Flexible closing dates: Time your sale for optimal tax planning

- Cost basis documentation: Help organize records to maximize deductions

Why Cash Sales Work Better for Tax Planning

Working with cash buyers like us offers unique tax advantages:

- No financing delays: Close when it's best for your tax situation

- Simplified 1099-S reporting: Cleaner documentation for tax filing

- No realtor commissions: Keep more money for tax obligations

- Professional guidance: We understand Wisconsin's tax requirements

I've seen too many landowners struggle with Wisconsin's tax complexity. Our straightforward cash buying process removes the guesswork while ensuring you get a fair offer and proper tax documentation. Contact us today if you’d like a free cash offer on your land.